Interim Report for the third quarter

NOVEMBER – JANUARY 2019

| Net sales | 1 845 (1 430) KSEK |

| Operating result | -4 744 (-2 426) KSEK |

| Net result | -6 147 (-3 724) KSEK |

| Earnings per share | -0.45 (-0.32) SEK |

MAY – JANUARY 2019 (YEAR TO DATE)

| Net sales | 3 240 (2 269) KSEK |

| Operating result | -12 471 (-6 438) KSEK |

| Net result | -16 700 (-10 298) KSEK |

| Earnings per share | -1.21 (-0.88) SEK |

IN SHORT

- Net sales for the third quarter increased by 29 % to 1 845 (1 430) KSEK and year to date net sales increased by 43 % to 3 240 (2 269) KSEK.

- Third quarter gross margin amounted to 71 (59) %.

- Rolling 12-month sales reached 5.4 (3.5) MSEK.

- The increased net loss is due to increased operating development costs and increased sales and marketing activities, not least on the important North American market.

- The explicit interest from the industry means that PHI enters a new stage, focused on actively establishing collaborations with one or more leading industry players.

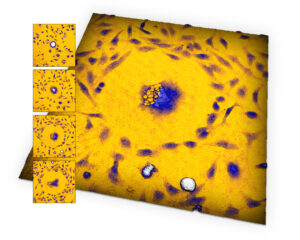

An extremely abnormal cancer cell. The image series was created by scientists at Northeastern University using HoloMonitor®

An extremely abnormal cancer cell. The image series was created by scientists at Northeastern University using HoloMonitor®

CEO COMMENTARY

The third quarter is characterized by strategic collaborations. After six months of scientific evaluation, the collaboration with BioSpherix moves into the next co-marketing stage, beginning at Society of Toxicology’s Annual Meeting now in March. BioSpherix develops and markets hermetically sealed cell incubators, which in contrast to the simple cell culturing cabinets commonly used today make it possible to mimic the oxygen-depleted environment inside the human body.

In parallel with BioSpherix’s evaluation, researchers at QIMR Berghofer Medical Research Institute in Brisbane have used HoloMonitor to investigate how oxygen depletion stimulates cancer cells to form metastases. The results from QIMR have been worth waiting for, as they are directly applicable to the co-marketing activities with BioSpherix by scientifically showing the value of combining the companies’ products.

In order to gain access to significantly larger sales and marketing organizations than PHI can build on its own, our strategy has from the start been to attract major industry players through initial sales and academic collaborations. When the collaborations have been established, our limited market organization will serve as market support for these international sales organizations. A well-developed market support that makes it easy to sell the product in question is often decisive for a successful sales collaboration with a major industry player, where a larger number of products compete for adequate sales representation.

Our strategic efforts have resulted in that we now are actively discussing with several major suppliers of laboratory equipment. So far, these discussions have led to a technology assessment agreement with one major supplier to evaluate our HoloMonitor technology within the field of immuno-oncology.

The international attention we have created in the industry now gives us two possibilities:

- We continue to focus our resources on short-term sales to slowly grow organically on our own or

- we invest our resources to at a later stage achieve more rapid sales growth through major industry players.

The opportunities created by the received attention make the choice easy. We will stay on course and spare no resources to on key markets successfully establish partnerships with major industry players, even if it may have an adverse effect on our short-term sales over a transitional period.

Link to the report.