february 2021 – april 2021

| Net sales | 1 910 (557) KSEK |

| Operating result before depreciation (EBITDA) | -5 559 (-4 589) KSEK |

| Net result | -6 784 (-6 538) KSEK |

| Earnings per share | -0.47 (-0.45) SEK |

| Gross margin | 66 (60) % |

May 2020 – april 2021

| Net sales | 3 637 (3 803) KSEK |

| Operating result before depreciation (EBITDA) | -16 773 (-18 692) KSEK |

| Net result | -23 509 (-26 313) KSEK |

| Earnings per share | -1.63 (-1.83) SEK |

| Gross margin | 63 (61) % |

In short

- The strategic shift to focus on digital sales & marketing has been successful, reflected in the sales increase during the latter part of the fiscal year.

- The North American market accounted for 2/3 of net sales during the quarter and nearly half during the year.

- The development work of providing HoloMonitor with fluorescence capability is proceeding according to plan.

- The strategic focus on digital sales & marketing led to organizational changes during the year.

CEO commentary

The conventional way of selling advanced scientific instrumentation has been for independent distributors to market, resell and service the product in an agreed geographical market. Until the pandemic, nobody in the industry really questioned this business model. It was simply how capital equipment was sold. However, the model is costly and resource-demanding, and sales will only be as good as the distributors.

Therefore, as soon as they can muster the investment, larger companies establish subsidiaries in the important markets to not remain dependent on the whims of independent distributors. The way out for smaller companies that cannot afford subsidiaries across the globe is to make themselves attractive for the larger companies. However, the larger companies know their value and ask a lot in return to channel products through their distribution network, no matter how novel and exciting the product is.

The “New Normal”

As we all know, digital sales & marketing have been around for some time. However, until the pandemic, it had a limited impact on the traditional distributor business model, as it remained unthinkable for customers to purchase advanced technical equipment “over the Internet”.

The widespread use of video communications during the pandemic has changed this. Now when we have gotten used to it and realized how much more efficient and climate-friendly it is, more and more people prefer that product demonstrations and training occur online rather than in physical meetings. This small but significant change in behavior is likely to transform our industry and how capital goods are sold.

Together with advanced digital marketing, the change allows smaller companies to more efficiently sell, distribute and service advanced equipment over a large geographical area without a traditional distribution network.

In other words, a consequence of the pandemic is that innovative smaller companies such as PHI can establish their products on the market on their own. With a well-established product, these companies can then and on more equal terms negotiate partnerships with the major players to further expand the market reach.

The Fluorescence Project

The development work of providing HoloMonitor with fluorescence capability is proceeding according to plan. Recently the project entered the second and possibly the final internal testing phase. For more information concerning the project, see Interim Report 3 2020/21.

The Organization

The strategic decision first outlined in Interim Report 3 2019/20 to focus on digital sales & marketing led to organizational changes during the year. In particular, digital marketing requires a different skill set than marketing through tradeshows and other traditional marketing activities. For an overview of the new organization, see PHI Management and Board.

Sales

The strategic shift has been a success, reflected in the sales increase during the latter part of the fiscal year. Unless lockdowns are reinstated in the major markets, we see that sales will continue to grow over the foreseeable future, not least in the North American market.

Peter Egelberg, CEO

In the spirit of doing everything online that can be done online, this report has been written online and directly in HTML. This and future reports can be comfortably read on any device, including the financial tables. Those who prefer to print and read the report on paper can do so by pressing the button below.

Net sales and result

Net sales for the fourth quarter amounted to 1 910 (557) KSEK and operating result before depreciation (EBITDA) to -5 559 (-4 589) KSEK. Net result amounted to -6 784 (-6 538) KSEK.

Investments

With an emphasis on application development and development of fluorescence capability, the company invested 4 261 (3 192) KSEK in the product, patent, and application development during the financial year.

Financing

Cash, cash equivalents, and unutilized granted credits amounted to 35 506 (16 484) KSEK by the end of the period. The equity ratio was 25 (80) %.

Rolling 12-month sales with trendline

Risks

The company may be affected by various factors, described in the 2019/20 Annual Report. These factors may individually or jointly increase risks for the operation and result of the company.

Accounting principles

The accounts are prepared in accordance with the Annual Accounts Act and general advice from the Swedish Accounting Standards Board BFNAR 2012:1 Annual accounts and consolidated accounts (K3).

Review

This interim report has not been subject to review by the company’s auditor.

Statements about the future

Statements concerning the company’s business environment and the future in this report reflect the board of director’s current view of future events and financial developments. Forward-looking statements only express the judgments and assumptions made by the board of directors on the day of the report. These statements have been carefully assessed. However, it is brought to the reader’s attention that these statements are associated with uncertainty, like all statements about the future.

Calendar

- September 2021, Annual report 2020/21

- September 29 2021, Interim Report 1 2021/22

About PHI

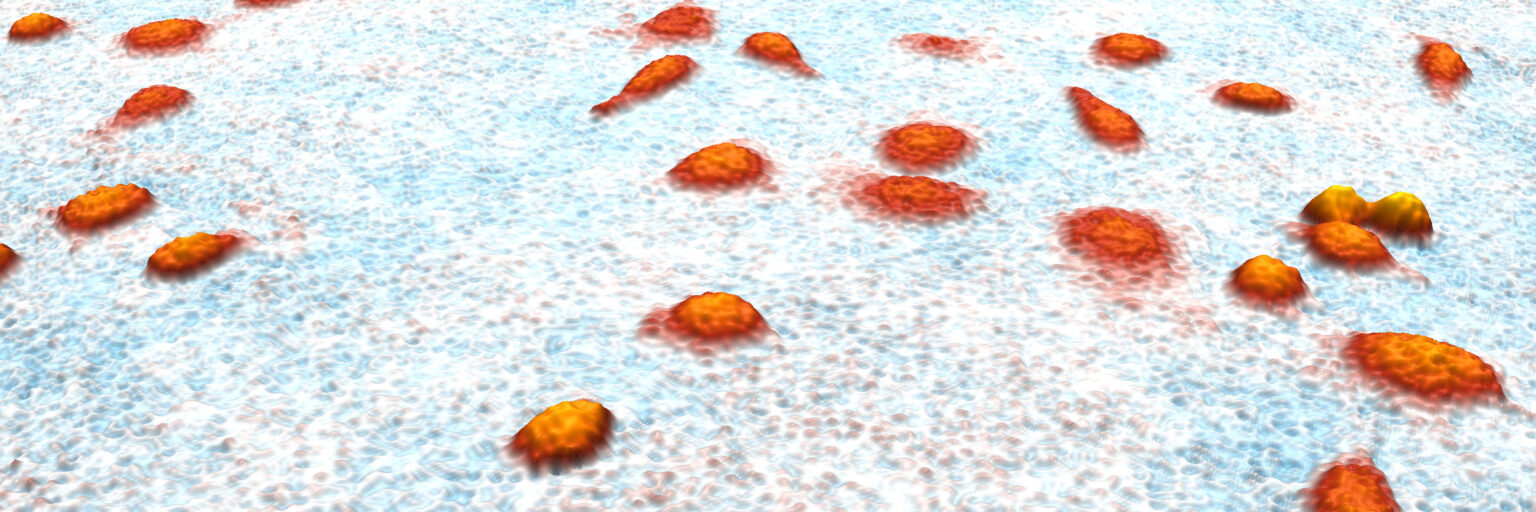

Phase Holographic Imaging (PHI) leads the ground-breaking development of time-lapse cytometry instrumentation and software. With the first HoloMonitor-instrument introduced in 2011, the company today offers a range of products for long-term quantitative analysis of living cell dynamics that circumvent the drawbacks of traditional methods requiring toxic stains. Committed to promoting the science and practice of time-lapse cytometry, PHI is actively expanding its customer base and scientific collaborations in cancer research, inflammatory and autoimmune diseases, stem cell biology, gene therapy, regenerative medicine and toxicological studies.

On behalf of the Board of Directors

Peter Egelberg, CEO

For additional information please contact:

Peter Egelberg

Tel: +46 703 19 42 74

E-mail: ir@phiab.se

Web: www.phiab.com

Consolidated – PHI Group

Income statement (KSEK)

| Q4 | Q4 | FY | FY | |

| 2020/21 | 2019/20 | 2020/21 | 2019/20 | |

| Net sales | 1 910 | 557 | 3 637 | 3 803 |

| Cost of products sold | -647 | -225 | -1 346 | -1 500 |

| Gross profit | 1 263 | 332 | 2 291 | 2 303 |

| Gross margin | 66% | 60% | 63% | 61% |

| Selling expenses | -3 511 | -2 211 | -8 773 | -8 756 |

| Administrative expenses | -1 775 | -1 576 | -7 084 | -6 428 |

| R&D expenses | -2 571 | -3 388 | -11 720 | -13 538 |

| Operating income | 367 | 1 972 | 367 | |

| Operating result (EBIT) | -6 594 | -6 476 | -23 314 | -26 052 |

| Financial net | -190 | -62 | -195 | -261 |

| Result before tax (EBT) | -6 784 | -6 538 | -23 509 | -26 313 |

| Net Result (EAT) | -6 784 | -6 538 | -23 509 | -26 313 |

Balance sheet (KSEK)

| FY | FY | |

| 2020/21 | 2019/20 | |

| ASSETS | ||

| Non-current assets | ||

| Intangible assets | 14 823 | 16 735 |

| Tangible assets | 337 | 704 |

| Total non-current assets | 15 160 | 17 439 |

| Current Assets | ||

| Inventory | 1 334 | 1 530 |

| Short-term receivables | 2 938 | 2 590 |

| Cash and equivalents | 2 256 | 14 484 |

| Total current assets | 6 528 | 18 604 |

| Total assets | 21 688 | 36 043 |

| EQUITY AND LIABILITIES | ||

| Equity | 5 384 | 28 896 |

| Financial liabilities | 7 400 | 1 125 |

| Operating liabilities | 8 904 | 6 022 |

| Total equity and liabilities | 21 688 | 36 043 |

Changes in equity (KSEK)

| FY | FY | |

| 2020/21 | 2019/20 | |

| Opening Balance | 28 896 | 37 653 |

| Equity issues, net | 17 487 | |

| Net profit | -23 509 | -26 313 |

| Translation difference | -3 | 69 |

| Closing balance | 5 384 | 28 896 |

| Equity ratio | 25% | 80% |

Cash flow analysis (KSEK)

| Q4 | Q4 | FY | FY | |

| 2020/21 | 2019/20 | 2020/21 | 2019/20 | |

| Operating activities | ||||

| Net result | -6 784 | -6 538 | -23 509 | -26 313 |

| Depreciation | 1 035 | 1 839 | 6 541 | 7 360 |

| Translation difference | -7 | -4 | 79 | |

| Operating cash flow | -5 756 | -4 699 | -16 972 | -18 874 |

| Increase (-)/decrease (+) in inventories | 327 | 190 | 196 | -148 |

| Increase (-)/decrease (+) in operating receivables | -392 | -190 | -348 | -9 |

| Increase (+)/decrease (-) in operating liabilities | 3 100 | -935 | 2 882 | -1 272 |

| Change in working capital | 3 035 | -935 | 2 730 | -1 429 |

| Cash flow from operating activities | -2 721 | -5 634 | -14 242 | -20 303 |

| Investing activities | ||||

| Development expenses | -1 384 | -714 | -4 091 | -2 729 |

| Patents | -170 | -62 | -170 | -266 |

| Tangible assets | -197 | -197 | ||

| Cash flow after investments | -4 275 | -6 607 | -18 503 | -23 495 |

| Financing activities | ||||

| Net proceeds from equity issues | 53 | 17 566 | ||

| Increase (+)/decrease (-) in borrowings | 3 150 | 375 | 6 275 | -750 |

| Cash flow from financing activities | 3 150 | 428 | 6 275 | 16 816 |

| Cash flow for the period | -1 125 | -6 179 | -12 228 | -6 847 |

| Cash and cash equivalents at the beginning of the period | 3 381 | 20 663 | 14 484 | 21 331 |

| Cash and cash equivalents at the end of the period | 2 256 | 14 484 | 2 256 | 14 484 |

| Incl. unutilized credits | 35 506 | 16 484 | 35 506 | 16 484 |

Data per share

| Q4 | Q4 | FY | FY | |

| 2020/21 | 2019/20 | 2020/21 | 2019/20 | |

| Earnings per Share, SEK | -0.47 | -0.45 | -1.63 | -1.83 |

| Equity per share, SEK | 0.37 | 2.01 | 0.37 | 2.01 |

| Number of Shares, end of period | 14 394 971 | 14 394 971 | 14 394 971 | 14 394 971 |

| Average number of shares | 14 394 971 | 14 394 971 | 14 394 971 | 14 386 521 |

| Share price at end of the period, SEK | 25.00 | 31.80 | 25.00 | 31.80 |

Parent company

Income statement (KSEK)

| Q4 | Q4 | FY | FY | |

| 2020/21 | 2019/20 | 2020/21 | 2019/20 | |

| Net sales | 1 405 | 557 | 2 991 | 3 716 |

| Cost of products sold | -676 | -227 | -1 358 | -1 502 |

| Gross profit | 729 | 330 | 1 633 | 2 214 |

| Gross margin | 52% | 59% | 55% | 60% |

| Selling expenses | -2 898 | -2 211 | -6 617 | -8 756 |

| Administrative expenses | -1 775 | -1 074 | -7 084 | -5 814 |

| R&D expenses | -2 571 | -3 388 | -11 720 | -13 538 |

| Other Income | 367 | 1 972 | 367 | |

| Operating result (EBIT) | -6 515 | -5 976 | -21 816 | -25 527 |

| Financial net* | -1 132 | -62 | -1 137 | -261 |

| Result before tax (EBT) | -7 647 | -6 038 | -22 953 | -25 788 |

| Net Result (EAT) | -7 647 | -6 038 | -22 953 | -25 788 |

Balance sheet (KSEK)

| FY | FY | |

| 2020/21 | 2019/20 | |

| ASSETS | ||

| Non-current assets | ||

| Intangible assets | 14 823 | 16 735 |

| Tangible assets | 337 | 704 |

| Financial assets* | 942 | |

| Total non-current assets | 15 160 | 18 381 |

| Current Assets | ||

| Inventory | 1 334 | 1 530 |

| Short-term receivables | 4 578 | 2 648 |

| Cash and equivalents | 1 711 | 13 940 |

| Total current assets | 7 623 | 18 118 |

| Total assets | 22 783 | 36 499 |

| EQUITY AND LIABILITIES | ||

| Equity | 6 399 | 29 352 |

| Financial liabilities | 7 400 | 1 125 |

| Operating liabilities | 8 984 | 6 022 |

| Total equity and liabilities | 22 783 | 36 499 |