Interim report 1 2025/26

Phase Holographic Imaging PHI AB (publ)

Lund, September 26, 2025

MAY 2025 – JULY 2025

| Net sales | 365 (1 338) KSEK |

| Operating result before depreciation (EBITDA) | -7 048 (-4 733) KSEK |

| Net result | -8 542 (-5 929) KSEK |

| Earnings per share | -0,14 (-0,23) SEK |

| Gross margin | 68 (83) % |

In Short

- The 21st of May Patrik Eschricht, former CEO of PHI came back as CEO.

- The 11th of July Altium A/S global distributor agreement was changed to a non-exclusivity agreement.

- The quarter’s sales have been affected by the change in sales strategy, from a global agreement with Altium A/S to direct sales from PHI to distributors.

CEO Commentary

The first quarter of the fiscal year marks a pivotal moment for PHI as we continue to build momentum across our strategic pillars. Our commitment to innovation, clinical integration, and global expansion remains steadfast, and the progress made this quarter reflects the dedication and ingenuity of our entire team.

We have made significant strides in the development of the new generation of the HoloMonitor® system, integrating AI-driven features that enhance data interpretation and automation. These advancements not only strengthen our product offering but also position PHI at the forefront of non-invasive cell analysis technologies.

Our efforts to deepen partnerships with clinical research centres and regulatory bodies are progressing well. These collaborations are essential as we move toward validating and certifying our systems for clinical use—an important step in expanding our impact within regenerative medicine and personalised healthcare.

PHI is again taking full control of its global sales operations as part of our strategic shift to accelerate international growth and strengthen customer engagement. We are also actively searching to enter new territories to expand our global footprint.

This transition, initiated during the summer months, a period traditionally marked by lower sales activity, was deliberately timed to minimize disruption. As a result, sales in the first quarter were temporarily impacted. However, this short-term dip reflects the structural change in sales strategy rather than underlying market demand.

Previously supported by Altium, a key investor and global distributor, PHI is now leveraging the foundation built through that partnership to independently drive market penetration and adoption of the HoloMonitor® system. By internalizing global sales, PHI gains greater control over its commercial strategy, enabling more targeted outreach, improved cash flow, and stronger alignment with its innovation roadmap.

This strategic move allows us to focus on our core strengths, advancing quantitative phase imaging (QPI) technology and developing cutting-edge solutions for regenerative medicine, while positioning PHI as a more agile and globally integrated player in the live-cell imaging market.

Future Outlook

Looking ahead, PHI is strategically positioned at the intersection of imaging technology and regenerative medicine. As the life sciences sector increasingly shifts toward personalised, cell-based therapies, the demand for non-invasive, real-time monitoring tools will only intensify. Our HoloMonitor® platform, built on Quantitative Phase Imaging (QPI), is uniquely suited to meet this need, offering a label-free, interference-free method for long-term cell tracking and analysis.

In the upcoming fiscal year, we will focus on four core areas:

- Clinical Integration: Deepening partnerships with clinical research centres and regulatory bodies to validate and certify our systems for clinical use.

- Product Innovation: Continuing development of the HoloMonitor® system, including AI-driven features that enhance automation and data interpretation.

- Global Reach: Expanding our market presence, particularly in North America and Asia, where regenerative medicine is gaining momentum.

- Commercial Control: Reclaiming full responsibility for global sales and marketing to ensure a consistent and responsive market approach.

We are also strengthening our alliances with leading institutions such as the Wake Forest Institute for Regenerative Medicine (WFIRM), which will play a key role in accelerating our clinical ambitions. These collaborations and strategic clarity position PHI to lead in the transformation of live cell analysis and regenerative medicine.

As I since May resumed leadership of PHI, I have done so with a renewed sense of purpose and optimism. Together, we are shaping a future where scientists and clinicians can interact with living cells in ways that were previously unimaginable.

About PHI

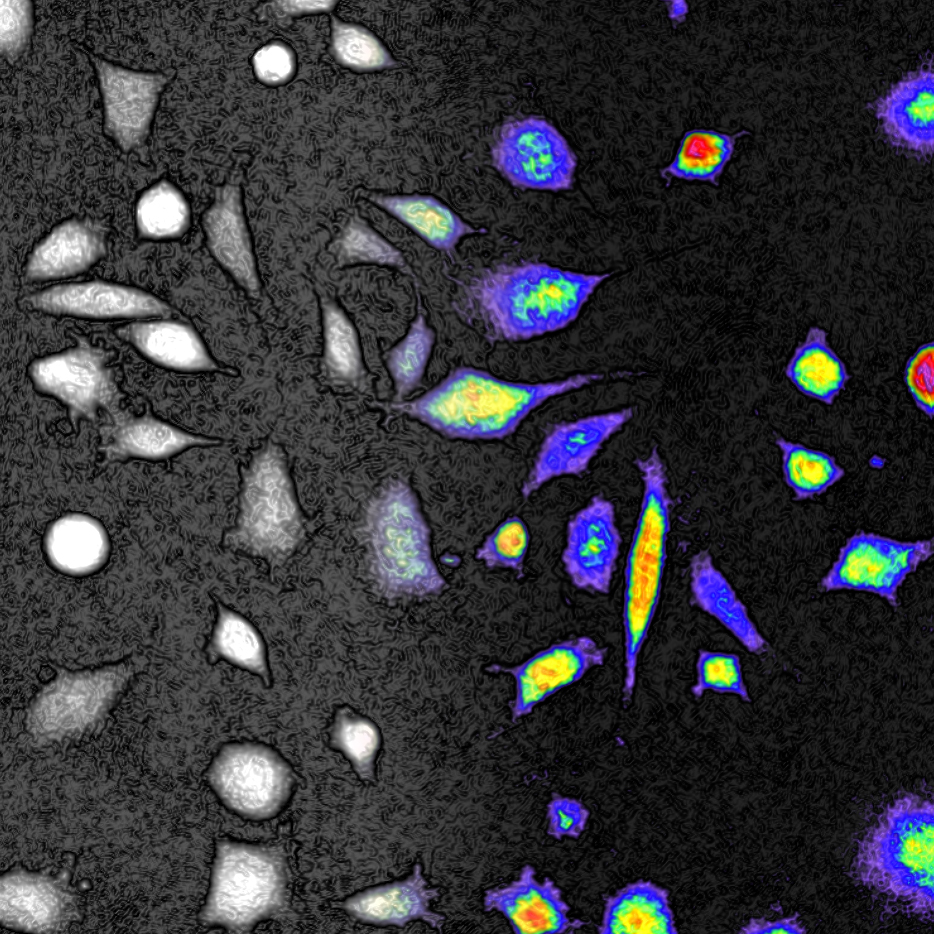

Phase Holographic Imaging (PHI), a leading medical technology company, develops and markets its non-invasive time-lapse imaging instruments for studying living cells.

The foundation of PHI’s current commercial HoloMonitor® products is Quantitative Phase Imaging (QPI) technology. This technology brings an innovative approach to real-time cell quality evaluation. It offers a detailed analysis of a large number of cell health and behavior characteristics without harming or influencing living cells and thus differing from conventional measurement methods, which often jeopardize cell integrity.

PHI is actively focusing on developing its business to expand from its current pre-clinical research market to the sizable healthcare industry and the emerging regenerative medicine field.

PHI envisions setting a new benchmark with QPI as a gold standard method for cell quality control, enabling regenerative treatments to advance and making future cell therapies safe, reliable, and economically and universally accessible for patients worldwide.

The addressable market

PHI has been active within the pre-clinical and biomedical cell research market, having established a global presence with HoloMonitor® systems and their scientific validation in both academia and industry, primarily addressing cancer, stem cell and drug development research.

PHI’s HoloMonitor technology is transforming pre-clinical research by providing a foundation for better cell models, which are critical before clinical drug testing. This innovative approach, utilizing Quantitative Phase Imaging (QPI), ensures cells remain unaffected during analysis. Unlike conventional cell measurement methods that often require genetic manipulation or staining with toxic substances, QPI offers a non-invasive alternative that maintains the integrity of cell cultures. This advancement addresses the critical need for accurate, cost-efficient preclinical data to reduce the high failure rates in drug development. With 9 out of 10 drugs failing in clinical trials due to ineffective results or adverse effects, largely stemming from flawed preclinical outcomes, PHI’s technology represents a significant leap forward. By enabling scientists to obtain better data without compromising cell health, HoloMonitor sets a new standard in drug development and basic medical research, aiming for more successful patient outcomes and reduced research expenses.

PHI is strategically prepared to extend its reach into the large clinical market and emerging regenerative medicine field, which presents significant growth opportunities. By striving to achieve Good Manufacturing Practice (GMP) standards and create a company quality management system (QMS), PHI aims to penetrate these markets in the future, where its non-invasive cell analysis solutions can offer critical cell quality control assessment.

Regenerative medicine is a groundbreaking field focused on developing methods to regenerate, repair, or replace damaged cells, tissues, or organs. It integrates biology, chemistry, computer science, and engineering to develop treatments for conditions previously thought untreatable. It has already begun to transform healthcare by offering new hope to patients with conditions like cancer, Parkinson’s disease, diabetes, and deafness, displaying its vast potential to improve and save lives around the globe.

Business model & strategy

PHI markets a competitive combination of sophisticated software and quality hardware, constantly evolving its offerings through in-house development in response to changing market needs. The production of the hardware and accessories is strategically outsourced to specialized subcontractors located in Sweden.

PHI’s business model strategically centers around the HoloMonitor portfolio, designed to meet the specific needs of academia and industry research labs. The company prioritizes direct interactions and live product demonstrations at potential customer facilities, particularly in cell-based research environments. Combined with a digital marketing approach, this sales strategy is essential for demonstrating HoloMonitor’s advantages firsthand, aiming to foster trust and enabling customers to assess its suitability for their unique research needs. The sales process at PHI is designed to align with the detailed and extended decision-making cycles often found within the scientific community. It accounts for the crucial phase of securing grant funding or other financial support for institutions looking to invest in new research equipment. As a result, sales cycles typically span 6 to 12 months.

Phase Holographic Imaging (PHI) is assuming full control of its global sales operations as part of a strategic initiative to accelerate international growth. While continuing to strengthen its presence in core markets—North America, Europe, Asia, and Australia—PHI is also actively entering new territories to broaden its global footprint.

Central to this transition is PHI’s evolving relationship with Altium, a key investor and former global distributor. Altium’s early involvement was instrumental in scaling PHI’s market presence, providing both financial support and access to established sales and distribution networks. With PHI now taking the lead on global sales, the company is leveraging the foundation built through this partnership to drive deeper market penetration and expand adoption of the HoloMonitor® system.

This shift allows PHI to align its commercial strategy more closely with its innovation roadmap, focusing on advancing quantitative phase imaging (QPI) technology and developing solutions tailored to regenerative medicine. By internalizing global sales, PHI is better positioned to optimize customer engagement, improve cash flow, and solidify its role as a global leader in live-cell imaging.

Achieving future goals

PHI is focusing on achieving important milestones in the coming years, utilizing the potential of its partnerships and collaborations. PHI has a clear focus on expanding its business to the clinical research market and positioning itself in the Regenerative Medicine field.

The collaboration with Altium is instrumental in PHI’s approach to gaining a stronger foothold in the regenerative medicine field, where PHI’s cell quality control technology can meet critical industry needs. PHI is also actively fostering alliances with leading institutions such as the Wake Forest Institute for Regenerative Medicine (WFIRM), renowned for its groundbreaking contributions to translating scientific research into clinical therapies. Collaborating with WFIRM enriches PHI’s initiatives, providing access to an exceptional ecosystem of expertise and innovation. This partnership bolsters PHI’s leadership in regenerative medicine, enabling the ongoing development and application of PHI’s cell quality control technology.

PHI engages in these strategic relationships to fortify the Company’s position as a thought leader in the field with the intention to accelerate progress, bolster market penetration, open new doors to new business opportunities, and enhance shareholder value.

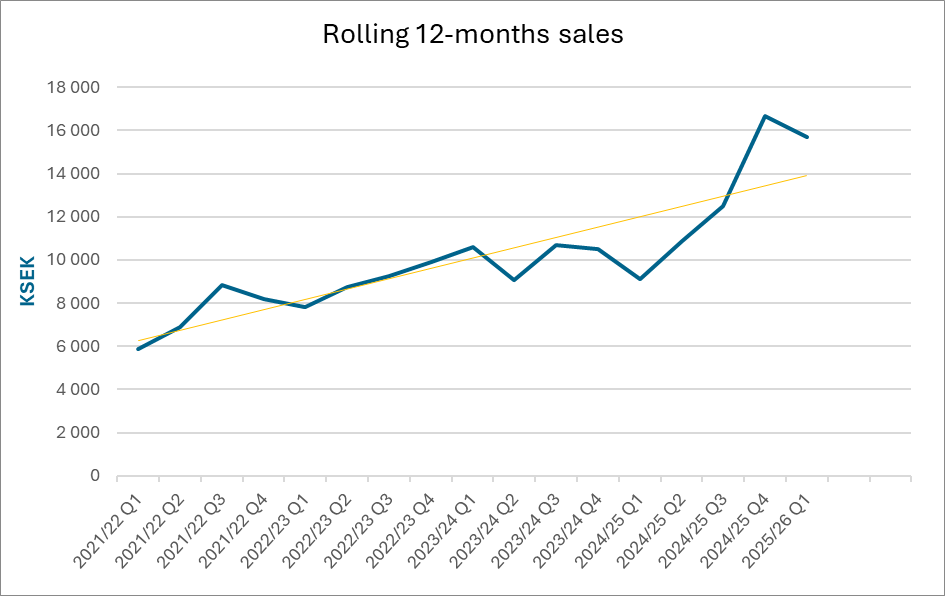

Net Sales and Result

Net sales for the first quarter amounted to 365 (1 338) KSEK. Operating results before depreciation (EBITDA) amounted to -7 048 (-4 733) KSEK for the first quarter. The net result for the first quarter amounted to -8 542 (-5 928) KSEK.

Investments

The company invested 1 146 (1 996) KSEK in the product, patent, and application development during the first quarter.

Financing

Cash, cash equivalents, and unutilized granted credits amounted to 12 670 (267) KSEK by the end of the period. The equity ratio was 89 (-2) %.

Risks

The company may be affected by various factors, described in the 2024/25 Annual Report. These factors may individually or jointly increase risks for the operation and result of the company.

Accounting Principles

The accounts are prepared in accordance with the Annual Accounts Act and general advice from the Swedish Accounting Standards Board BFNAR 2012:1 Annual accounts and consolidated accounts (K3).

Review

This interim report has not been subject to review by the company’s auditor.

Statements About the Future

Statements concerning the company’s business environment and the future in this report reflect the board of director’s current view of future events and financial developments. Forward-looking statements only express the judgments and assumptions made by the board of directors on the day of the report. These statements have been carefully assessed. However, it is brought to the reader’s attention that these statements are associated with uncertainty, like all statements about the future.

Calendar

- End of September: Publication of annual report, which will be available in PHI office in Lund and on www.phiab.com

- 16th General annual meeting at PHI office in Lund

- End of September: Publication of annual report, which will be available in PHI office in Lund and on www.phiab.com

- 19th of December, Interim Report 2 2024/2025

About PHI

Phase Holographic Imaging (PHI) is a medical technology company that develops and markets its non-invasive, time-lapse imaging instruments for long-term quantitative analysis of living cells. The foundation of PHI’s current commercial HoloMonitor® products is Quantitative Phase Imaging (QPI) — a technology that heralds an innovative approach to cell quality evaluation. It offers a detailed analysis of cell characteristics without harming the cells, avoiding the limitations of traditional measurement methods. PHI is actively focusing on business development to expand from pre-clinical research to the clinical market and the emerging regenerative medicine field. PHI envisions transforming live cell analysis and establishing QPI as a standard for cell quality control, making our future cell therapies safe, affordable, and accessible for patients. PHI is based in Lund, Sweden, Boston, MA and Winston-Salem, NC.

On behalf of the Board of Directors

Patrik Eschricht, CEO

For additional information, please contact:

Patrik Eschricht

Tel: +46 702 69 99 61

E-mail: ir@phiab.com

Web: www.phiab.com

Consolidated – PHI Group

Income statement (KSEK)

| Q1 | Q1 | FY | |

| 2025/26 | 2024/25 | 2024/25 | |

| Net sales | 365 | 1 338 | 16 646 |

| Cost of products sold | -115 | -234 | -4 409 |

| Gross profit | 250 | 1 104 | 12 237 |

| Gross margin | 68% | 83% | 74% |

| Selling expenses | -3 276 | -2 447 | -9 104 |

| Administrative expenses | -2 824 | -2 280 | -10 870 |

| R&D expenses | -2 900 | – 1 499 | -7 215 |

| Operating result (EBIT) | -8 750 | -5 928 | -14 952 |

| Financial net | 208 | -807 | -2 568 |

| Result before tax (EBT) | -8 542 | -5 928 | -17 519 |

| Net Result (EAT) | -8 542 | -5 928 | -17 519 |

Balance sheet (KSEK)

| Q1 | Q1 | FY | |

| 2025/26 | 2024/25 | 2024/25 | |

| ASSETS | |||

| Non-current assets | |||

| Intangible assets | 29 893 | 27 336 | 30 345 |

| Tangible assets | 973 | 941 | 1 048 |

| Financial assets | 134 | 132 | |

| Total non-current assets | 30 999 | 28 277 | 31 525 |

| Current Assets | |||

| Inventory | 1 392 | 3 650 | 2 640 |

| Short-term receivables | 1 738 | 3 423 | 7 244 |

| Cash and equivalents | 10 670 | 11 | 14 443 |

| Total current assets | 13 800 | 7 084 | 24 327 |

| Total assets | 44 800 | 35 361 | 55 853 |

| EQUITY AND LIABILITIES | |||

| Equity | 40 032 | -716 | 48 738 |

| Financial liabilities | 18 157 | ||

| Operating liabilities | 4 768 | 17 920 | 7 115 |

| Total equity and liabilities | 44 800 | 35 361 | 55 853 |

Changes in equity (KSEK)

| Q1 | Q1 | FY | |

| 2025/26 | 2024/25 | 2024/25 | |

| Opening Balance | 48 738 | 4 988 | 4 988 |

| Equity issues, net | 59 535 | ||

| Net profit | -8 542 | -5 929 | -17 520 |

| Translation difference | -164 | 224 | 1 735 |

| Closing balance | 40 032 | -716 | 48 738 |

| Equity ratio | 89% | -2% | 87 % |

Cash flow analysis (KSEK)

| Q4 | Q4 | FY | |

| 2024/25 | 2023/24 | 2024/25 | |

| Operating activities | |||

| Net result | -8 542 | -5 929 | -17 520 |

| Depreciation | 1 702 | 389 | 2 881 |

| Translation difference | -203 | 59 | 2 241 |

| Operating cash flow | -7 042 | -5 481 | -12 397 |

| Increase (-)/decrease (+) in inventories | 1 256 | 82 | 983 |

| Increase (-)/decrease (+) in operating receivables | 5 505 | -1 049 | -4 899 |

| Increase (+)/decrease (-) in operating liabilities | -416 | 7 751 | -2 295 |

| Change in working capital | 6 345 | 6 784 | -6 211 |

| Cash flow from operating activities | -697 | 1 303 | -18 608 |

| Investing activities | |||

| Development expenses | -1 146 | -1 996 | -7 694 |

| Tangible assets | -322 | ||

| Cash flow after investments | -1 842 | -693 | -26 624 |

| Financing activities | |||

| Net proceeds from equity issues | 224 | 59 535 | |

| Increase (+)/decrease (-) in borrowings | 312 | -18 791 | |

| Utilized credits | -1 932 | 195 | |

| Cash flow from financing activities | -1 932 | 536 | 40 938 |

| Cash flow for the period | -3 775 | -157 | 14 315 |

| Cash and cash equivalents at the beginning of the period | 14 443 | 167 | 167 |

| Cash and cash equivalents at the end of the period | 10 670 | 11 | 14 443 |

| Incl. unutilized credits | 12 670 | 267 | 14 509 |

Data per share

| Q1 | Q1 | FY | |

| 2025/26 | 2024/25 | 2024/25 | |

| Earnings per Share, SEK | -0,14 | -0,23 | -0,40 |

| Equity per share, SEK | 0,63 | -0,03 | 0,77 |

| Number of Shares, end of period | 63 051 780 | 26 192 925 | 63 051 780 |

| Average number of shares | 63 051 780 | 26 192 925 | 44 238 600 |

| Share price end of period, SEK | 1,16 | 7,80 | 1,40 |

Parent company

Income statement (KSEK)

| Q1 | Q1 | FY | |

| 2025/26 | 2024/25 | 2024/25 | |

| Net sales | 288 | 1 295 | 16 101 |

| Cost of products sold | -115 | -223 | -4 288 |

| Gross profit | 173 | 1 072 | 11 813 |

| Gross margin | 60% | 83% | 73% |

| Selling expenses | -1 817 | -1 193 | -4 279 |

| Administrative expenses | -2 823 | -2 280 | -10 863 |

| R&D expenses | -2 900 | -1 499 | -7 215 |

| Operating result (EBIT) | -7 368 | -3 900 | -10 544 |

| Financial net | -719 | -807 | -20 842 |

| Result before tax (EBT) | -8 087 | -4 707 | -31 386 |

| Net Result (EAT) | -8 087 | -4 707 | -31 386 |

Balance sheet (KSEK)

| Q1 | Q1 | FY | |

| 2025/26 | 2024/25 | 2024/25 | |

| ASSETS | |||

| Non-current assets | |||

| Intangible assets | 27 119 | 25 416 | 27 600 |

| Tangible assets | 973 | 941 | 1 048 |

| Financial assets | 25 | 14 916 | 25 |

| Total non-current assets | 28 117 | 41 273 | 28 673 |

| Current Assets | |||

| Inventory | 615 | 2 674 | 1 871 |

| Short-term receivables | 1 651 | 3 101 | 6 992 |

| Cash and equivalents | 10 468 | 13 777 | |

| Total current assets | 12 734 | 5 775 | 22 640 |

| Total assets | 40 851 | 47 048 | 51 314 |

| EQUITY AND LIABILITIES | |||

| Equity | 36 162 | 11 394 | 44 249 |

| Financial liabilities | 17 841 | ||

| Operating liabilities | 4 689 | 17 813 | 7 065 |

| Total equity and liabilities | 40 851 | 47 048 | 51 314 |