Interim Report 3 2023/24

Phase Holographic Imaging PHI AB (publ)

Lund, March 27, 2024

NOVEMBER 2023 – January 2024

| Net sales | 4 873 (3 264) KSEK |

| Operating result before depreciation (EBITDA) | -3 179 (-3 453) KSEK |

| Net result | -5 152 (-4 412) KSEK |

| Earnings per share | -0.21 (-0.22) SEK |

| Gross margin | 72 (60) % |

MAY 2023 – JANUARY 2024

| Net sales | 8 824 (8 031) KSEK |

| Operating result before depreciation (EBITDA) | -9 568 (-12 626) KSEK |

| Net result | -14 826 (-15 468) KSEK |

| Earnings per share | -0.61 (-0.76) SEK |

| Gross margin | 73 (56) % |

In Short

- PHI reached a proud financial milestone with net sales amounting to a total of 4.9 MSEK, marking the highest ever in company history.

- PHI and its partner Altium have entered into a distribution agreement that grants Altium the right to market and sell PHI’s products in order to actively leverage its extensive distributor network and global sales contacts and to significantly influence PHI’s product sales in its designated territories.

- PHI has been granted a patent on synthetic antibodies from the European Patent Office, complementing its portfolio with corresponding patents in the US and Japan.

- PHI positions itself as a thought leader by actively engaging in the regenerative medicine community. In the recently published opinion piece titled “Shaping the Future of Regenerative Medicine – PHI’s Vision for QPI in Cell Therapy Manufacturing”, PHI details the versatility and potential for QPI technology in regenerative medicine and the technology’s capability to enhance cell quality control throughout the whole cell manufacturing cycle – from bedside to bedside.

CEO Commentary

We are pleased with the performance of this quarter, which has been marked by outstanding success. This period set new records for PHI, achieving our highest-ever sales and advancing our strategic initiatives significantly. The strengthening of our partnership with Altium and the expanding reach of our Quantitative Phase Imaging (QPI) technology highlights our leading position in the field. This quarter truly shows our continuous progress toward our core mission: making cell-based therapies accessible, affordable, and safe for all.

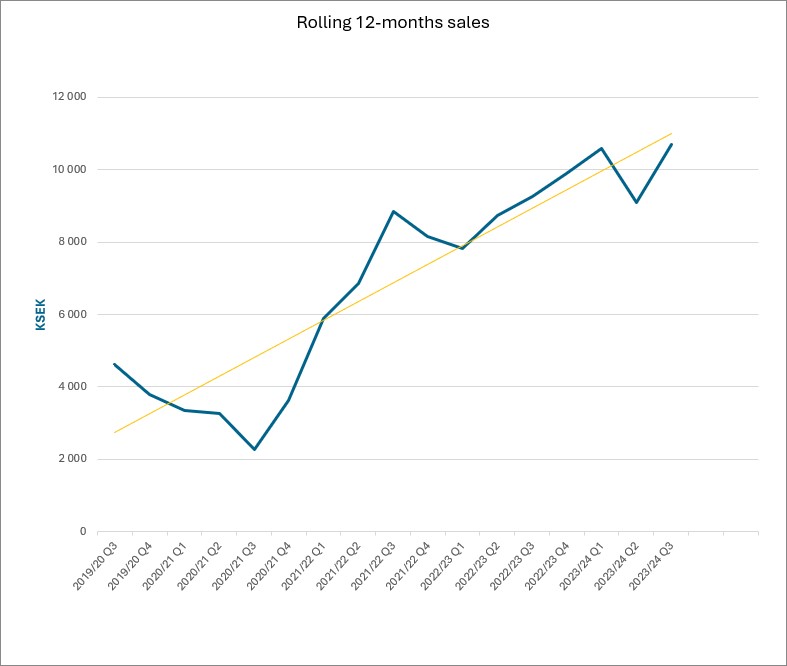

A historic milestone in sales performance

In the third quarter, PHI reached a financial milestone with net sales amounting to a total of 4.9 MSEK, marking the highest ever in company history. This notable increase in sales was sparked by initial orders from five Altium subsidiaries for HoloMonitor systems, strategically intended to support Altium’s sales efforts. These systems are used in Altium’s sales processes, such as product demonstrations at customer sites, with the aim of generating future sales opportunities. We have great confidence in Altium’s capacity to leverage their extensive distributor network and global sales expertise, and we are particularly encouraged by their rapid contributions to our growth. Their efforts are expected to not only increase our geographic footprint but also have a positive impact on our sales and cash flow moving forward.

While we celebrate this quarter’s sales achievement, we remain aware of the market’s sales unpredictability. The pre-clinical research market is characterized by complex and often lengthy sales cycles as researchers and academics seek funding for new research equipment investments. We are mindful of this situation, yet we are optimistic that our productive collaboration with Altium will maintain a positive sales trajectory.

Building on the momentum of our record-setting quarter, we were excited to announce the appointment of Daniel Soors as PHI’s dedicated distributor partner manager at Altium. This strategic role is expected to expand the global reach and sales performance of PHI’s HoloMonitor technology. With Daniel’s leadership, we are set to unlock new markets, establish new distributor partnerships, and leverage an advanced sales and marketing toolkit to refine our operations. This initiative is perfectly aligned with our ambition to extend HoloMonitor’s global presence and deepen our engagement within the scientific community.

The emerging market of regenerative medicine

In line with our unwavering commitment to regenerative medicine, a recent highlight has shown the field’s growing significance and our strategic position within it. The Wake Forest Institute for Regenerative Medicine (WFIRM), a key collaborator of PHI, has been awarded a USD 160 million grant from the US National Science Foundation over ten years. This recognition positions Winston-Salem, and by extension PHI through our partnership, at the forefront of global regenerative medicine innovation.

This grant not only cements the area’s reputation as a pivotal hub for regenerative medicine but also reflects positively on our joint efforts. While the direct benefits to PHI from this grant are still unfolding, the increased visibility and acknowledgment it brings can undoubtedly lead to enhanced business opportunities and further collaborations.

Envisioning the future

Back in November, PHI strengthened our intellectual property as the European Patent Office granted us a patent for synthetic antibodies in the EU, an important accomplishment in relation to our GlycoImaging project. This achievement complements PHI’s corresponding patents in the US and Japan, which were granted in 2020 and 2022, respectively. Recognizing the potential of this innovation for early cancer detection, we are prepared to engage with interested parties who see value in this advanced diagnostic approach. As such, we are open to strategic opportunities that may arise while keeping our primary focus on our core business, innovation, and product development related to HoloMonitor and QPI.

Looking ahead, we are strategically focusing on positioning ourselves in the emerging regenerative medicine market, establishing QPI technology as a gold standard for cell quality control. Our strategic alignment with Altium and our collaborative efforts with pioneering research institutions are clear examples of initiatives that are motivated to allow us to advance into the field of regenerative therapies.

As we navigate through this transformative era, our focus remains steadfast on empowering labs worldwide with our non-invasive, cell-friendly technologies, striving toward ensuring the safe, affordable, and accessible future of healthcare.

In closing, I extend my gratitude to our team, partners, and stakeholders for their support and belief in our vision. Together, we are not just witnessing the evolution of regenerative medicine; we are actively shaping it.

Warmest springtime wishes and happy Easter!

About PHI

Phase Holographic Imaging (PHI), a leading medical technology company, develops and markets its non-invasive time-lapse imaging instruments for studying living cells.

The foundation of PHI’s current commercial HoloMonitor® products is Quantitative Phase Imaging (QPI) technology. This technology brings an innovative approach to real-time cell quality evaluation. It offers a detailed analysis of a large number of cell health and behavior characteristics without harming or influencing living cells and thus differing from conventional measurement methods, which often jeopardize cell integrity.

PHI is actively focusing on developing its business to expand from its current pre-clinical research market to the sizable healthcare industry and the emerging regenerative medicine field.

PHI envisions setting a new benchmark with QPI as a gold standard method for cell quality control, enabling regenerative treatments to advance and making future cell therapies safe, reliable, and economically and universally accessible for patients worldwide.

The addressable market

PHI has been active within the pre-clinical and biomedical cell research market, having established a global presence with HoloMonitor® systems and their scientific validation in both academia and industry, primarily addressing cancer, stem cell and drug development research.

PHI’s HoloMonitor technology is transforming pre-clinical research by providing a foundation for better cell models, which are critical before clinical drug testing. This innovative approach, utilizing Quantitative Phase Imaging (QPI), ensures cells remain unaffected during analysis. Unlike conventional cell measurement methods that often require genetic manipulation or staining with toxic substances, QPI offers a non-invasive alternative that maintains the integrity of cell cultures. This advancement addresses the critical need for accurate, cost-efficient preclinical data to reduce the high failure rates in drug development. With 9 out of 10 drugs failing in clinical trials due to ineffective results or adverse effects, largely stemming from flawed preclinical outcomes, PHI’s technology represents a significant leap forward. By enabling scientists to obtain better data without compromising cell health, HoloMonitor sets a new standard in drug development and basic medical research, aiming for more successful patient outcomes and reduced research expenses.

PHI is strategically prepared to extend its reach into the large clinical market and emerging regenerative medicine field, which presents significant growth opportunities. By striving to achieve Good Manufacturing Practice (GMP) standards and create a company quality management system (QMS), PHI aims to penetrate these markets in the future, where its non-invasive cell analysis solutions can offer critical cell quality control assessment.

Regenerative medicine is a groundbreaking field focused on developing methods to regenerate, repair, or replace damaged cells, tissues, or organs. It integrates biology, chemistry, computer science, and engineering to develop treatments for conditions previously thought untreatable. It has already begun to transform healthcare by offering new hope to patients with conditions like cancer, Parkinson’s disease, diabetes, and deafness, displaying its vast potential to improve and save lives around the globe.

Business model & strategy

PHI markets a competitive combination of sophisticated software and quality hardware, constantly evolving its offerings through in-house development in response to changing market needs. The production of the hardware and accessories is strategically outsourced to specialized subcontractors located in Sweden.

PHI’s business model strategically centers around the HoloMonitor portfolio, designed to meet the specific needs of academia and industry research labs. The company prioritizes direct interactions and live product demonstrations at potential customer facilities, particularly in cell-based research environments. Combined with a digital marketing approach, this sales strategy is essential for demonstrating HoloMonitor’s advantages firsthand, aiming to foster trust and enabling customers to assess its suitability for their unique research needs. The sales process at PHI is designed to align with the detailed and extended decision-making cycles often found within the scientific community. It accounts for the crucial phase of securing grant funding or other financial support for institutions looking to invest in new research equipment. As a result, sales cycles typically span 6 to 12 months.

PHI is actively expanding its global reach within its current core markets, such as North America, Europe, Asia, and Australia, while also exploring new territories. At the heart of this strategic expansion is the partnership with Altium, a major investor and global distributor of PHI. Altium’s engagement has been transformative for PHI’s operations, not only providing substantial financial backing but also significantly enhancing PHI’s market presence through Altium’s well-established sales channels and distribution networks. The joint efforts aim to broaden the geographic reach and adoption of the HoloMonitor system, utilizing targeted demonstrations and deeper market penetration to enhance sales performance and cash flow, positioning PHI as a key player in its field. This collaboration enables PHI to focus on its core expertise and innovation capabilities—advancing QPI technology and product development within regenerative medicine.

Achieving future goals

PHI is focusing on achieving important milestones in the coming years, utilizing the potential of its partnerships and collaborations. PHI has a clear focus on expanding its business to the clinical research market and positioning itself in the Regenerative Medicine field.

The collaboration with Altium is instrumental in PHI’s approach to gaining a stronger foothold in the regenerative medicine field, where PHI’s cell quality control technology can meet critical industry needs. PHI is also actively fostering alliances with leading institutions such as the Wake Forest Institute for Regenerative Medicine (WFIRM), renowned for its groundbreaking contributions to translating scientific research into clinical therapies. Collaborating with WFIRM enriches PHI’s initiatives, providing access to an exceptional ecosystem of expertise and innovation. This partnership bolsters PHI’s leadership in regenerative medicine, enabling the ongoing development and application of PHI’s cell quality control technology.

PHI engages in these strategic relationships to fortify the Company’s position as a thought leader in the field with the intention to accelerate progress, bolster market penetration, open new doors to new business opportunities, and enhance shareholder value.

Net Sales and Result

Net sales for the third quarter amounted to 4 873 (3 264) KSEK and operating results before depreciation (EBITDA) to -3 179 (-3 453) KSEK. The net result amounted to -5 152 (-4 412) KSEK.

Investments

With an emphasis on regenerative medicine, the company invested 2 830 (1 195) KSEK in the product, patent, and application development during the period.

Financing

Cash, cash equivalents, and unutilized granted credits amounted to 664 (13 572) KSEK by the end of the period. Cash was influenced at the end of the period by many late deliverances, invoiced but not paid. The equity ratio was 30 (29) %.

Warrants of series TO 3

On 2 May 2023, the exercise period for warrants of series TO 3 (“TO 3”), which were issued in connection with Phase Holographic Imaging PHI AB’s (“PHI” or the “Company”) rights issue of units that were announced on 22 February 2022, ended. 3 201 739 warrants of series TO 3 were exercised, corresponding to a subscription ratio of approximately 95.1 percent. Thus, the underwriting commitment relating to TO 3, which the Company agreed on during the exercise period, was activated. The decision on a directed share issue of 163 666 shares, corresponding to the remaining approximately 4.9 percent of the warrant exercise, to the underwriter Altium SA (“Altium”) was taken, with the support of the authorization given by the annual general meeting held on 31 October 2022. The proceeds of the TO 3 warrants amount to approximately SEK 12.7 million before the deduction of transaction-related costs, corresponding to a subscription rate of 100 percent.

Warrants of series TO 4

Each warrant of series TO 4 entitles to subscribe for one (1) new share in PHI during the period from and including 12 September 2024 to and including 3 October 2024. The exercise price amounts to 70 % of the volume-weighted average price during a period prior to option redemption, within the interval 0.20 SEK as the lowest, and with 15.45 SEK per new share as the highest exercise price. Upon full exercise of warrants of series TO 4 at the highest exercise price (15.45 SEK per new share), the warrants will provide the company with approximately 20.8 MSEK before issue costs.

Convertibles

The convertible loan to Formue Nord Fokus A/S end of October 2023 amounted to 20 230 000 SEK with the following terms:

- Number of convertibles: 1 700 000 convertibles, which entails the right to subscribe for 1 700 000 new shares.

- Conversion rates: 11.90 SEK per new share until 2 May 2023 (last day in the exercise period for warrants of series TO 3) and 15.45 SEK per new share from May 3, 2023, until October 16, 2024.

- Conversion period: the convertible holder is entitled during the period from the date of payment to October 16, 2024, to convert the loan into shares.

- Maturity: in the event that the entire loan is not converted, repayment of the loan and interest must take place no later than October 16, 2024. The company has the right to repay all or part of the convertible loan at any time until the due date, after which Formue Nord has the opportunity to accept repayment or request conversion according to the above conversion rates.

- Interest: the convertibles run at a quarterly interest rate of 3%.

Altium acquired Formues Convertible loan

In November, Altium acquired the convertibles from Formue Nord A/S. On the take-over day, PHI had re-payed 6 360 KSEK on the convertible loan including accumulated interest. The convertible loan net amount that Altium took over amounted to 17 841 KSEK and the number of outstanding convertibles to 1 449 277 new shares.

Risks

The company may be affected by various factors, described in the 2022/23 Annual Report. These factors may individually or jointly increase risks for the operation and result of the company.

Accounting Principles

The accounts are prepared in accordance with the Annual Accounts Act and general advice from the Swedish Accounting Standards Board BFNAR 2012:1 Annual accounts and consolidated accounts (K3).

Review

This interim report has not been subject to review by the company’s auditor.

Statements About the Future

Statements concerning the company’s business environment and the future in this report reflect the board of director’s current view of future events and financial developments. Forward-looking statements only express the judgments and assumptions made by the board of directors on the day of the report. These statements have been carefully assessed. However, it is brought to the reader’s attention that these statements are associated with uncertainty, like all statements about the future.

Calendar

- 26th of June, 2024, Year-end report 2023/24

About PHI

Phase Holographic Imaging (PHI) is a medical technology company that develops and markets its non-invasive, time-lapse imaging instruments for long-term quantitative analysis of living cells. The foundation of PHI’s current commercial HoloMonitor® products is Quantitative Phase Imaging (QPI) — a technology that heralds an innovative approach to cell quality evaluation. It offers a detailed analysis of cell characteristics without harming the cells, avoiding the limitations of traditional measurement methods. PHI is actively focusing on business development to expand from pre-clinical research to the clinical market and the emerging regenerative medicine field. PHI envisions transforming live cell analysis and establishing QPI as a standard for cell quality control, making our future cell therapies safe, affordable, and accessible for patients. PHI is based in Lund, Sweden, Boston, MA and Winston-Salem, NC.

On behalf of the Board of Directors

Patrik Eschricht, CEO

For additional information, please contact:

Patrik Eschricht

Tel: +46 702 69 99 61

E-mail: ir@phiab.com

Web: www.phiab.com

Consolidated – PHI Group

Income statement (KSEK)

| Q3 | Q3 | YTD | YTD | FY | |

| 2023/24 | 2022/23 | 2023/24 | 2022/23 | 2022/23 | |

| Net sales | 4 873 | 3 264 | 8 824 | 8 031 | 9 900 |

| Cost of products sold | -1 374 | -1 304 | -2 390 | -3 539 | -4 832 |

| Gross profit | 3 499 | 1 960 | 6 434 | 4 492 | 5 068 |

| Gross margin | 72% | 60% | 73% | 56% | 51% |

| Selling expenses | -2 848 | -1 974 | -8 243 | -7 634 | -10 468 |

| Administrative expenses | -1 590 | -2 671 | -3 379 | -6 510 | -8 170 |

| R&D expenses | -2 363 | -1 641 | -6 244 | -5 579 | -6 782 |

| Operating result (EBIT) | -3 302 | -4 327 | -11 432 | -15 231 | -20 352 |

| Financial net | -1 850 | -85 | -3 394 | -237 | -2 833 |

| Result before tax (EBT) | -5 152 | -4 412 | -14 826 | -15 468 | -23 185 |

| Net Result (EAT) | -5 152 | -4 412 | -14 826 | -15 486 | -23 185 |

Balance sheet (KSEK)

| Q3 | Q3 | FY | |

| 2023/24 | 2022/23 | 2022/23 | |

| ASSETS | |||

| Non-current assets | |||

| Intangible assets | 24 202 | 17 825 | 19 654 |

| Tangible assets | 613 | 652 | 608 |

| Total non-current assets | 25 543 | 18 477 | 20 262 |

| Current Assets | |||

| Inventory | 4 752 | 3 657 | 3 846 |

| Short-term receivables | 5 638 | 6 051 | 5 293 |

| Cash and equivalents | 21 | 11 572 | 5 308 |

| Total current assets | 10 411 | 21 280 | 14 447 |

| Total assets | 35 954 | 39 757 | 34 709 |

| EQUITY AND LIABILITIES | |||

| Equity | 10 892 | 11 357 | 3 728 |

| Financial liabilities | 18 191 | 22 380 | 20 580 |

| Operating liabilities | 6 871 | 6 020 | 10 401 |

| Total equity and liabilities | 35 954 | 39 757 | 34 709 |

Changes in equity (KSEK)

| Q3 | Q3 | FY | |

| 2023/24 | 2022/23 | 2022/23 | |

| Opening Balance | 5 546 | 15 547 | 26 983 |

| Equity issues, net | 10 497 | ||

| Net profit | -5 152 | -4 412 | -23 185 |

| Translation difference | 222 | -70 | |

| Closing balance | 10 892 | 11 357 | 3 728 |

| Equity ratio | 30% | 29% | 11% |

Cash flow analysis (KSEK)

| Q3 | Q3 | YTD | YTD | FY | |

| 2023/24 | 2022/23 | 2023/24 | 2022/23 | 2022/23 | |

| Operating activities | |||||

| Net result | -5 152 | -4 412 | -9 675 | -15 468 | -23 185 |

| Depreciation | 876 | 874 | 1 742 | 2 605 | 3 486 |

| Translation difference | 296 | 312 | 140 | 312 | -70 |

| Operating cash flow | -3 979 | -3 226 | -7 793 | -12 551 | -19 644 |

| Increase (-)/decrease (+) in inventories | 180 | 490 | -1 086 | -678 | -867 |

| Increase (-)/decrease (+) in operating receivables | -2 198 | -2 927 | 1 982 | 29 540 | 30 639 |

| Increase (+)/decrease (-) in operating liabilities | -1 625 | -1 579 | -2 033 | -1 256 | 3 211 |

| Change in working capital | -3 643 | -4 016 | -1 137 | 27 606 | 32 983 |

| Cash flow from operating activities | -7 622 | -7 242 | -8 930 | 15 055 | 13 339 |

| Investing activities | |||||

| Development expenses | -2 805 | -1 195 | -4 249 | -3 325 | -5 938 |

| Patents | -25 | 25 | -179 | ||

| Tangible assets | -146 | -538 | -538 | -538 | |

| Cash flow after investments | -10 598 | -8 975 | -13 153 | 11 192 | 6 684 |

| Financing activities | |||||

| Net proceeds from equity issues | 10 497 | ||||

| Increase (+)/decrease (-) in borrowings | 132 | -3 524 | -1 044 | -2 801 | |

| Cash flow from financing activities | 10 497 | 132 | 7 968 | -1 044 | -2 801 |

| Cash flow for the period | -101 | -8 843 | -5 286 | 10 148 | 3 884 |

| Cash and cash equivalents at the beginning of the period | 122 | 20 415 | 5 307 | 1 424 | 1 424 |

| Cash and cash equivalents at the end of the period | 21 | 11 572 | 21 | 11 572 | 5 308 |

| Incl. unutilized credits | 664 | 13 572 | 664 | 13 572 | 7 307 |

Data per share

| Q3 | Q3 | YTD | YTD | FY | |

| 2023/24 | 2022/23 | 2023/24 | 2022/23 | 2022/23 | |

| Earnings per Share, SEK | -0,21 | -0,22 | -0,61 | -0,76 | -1,16 |

| Equity per share, SEK | 0,21 | 0,26 | 0,21 | 0,76 | 0,18 |

| Number of Shares, end of period | 26 192 925 | 20 452 700 | 26 192 925 | 20 452 700 | 20 452 700 |

| Average number of shares | 24 354 950 | 20 452 700 | 24 354 950 | 20 452 700 | 20 070 980 |

| Share price end of period, SEK | 6,46 | 1,9 | 6,46 | 1,9 | 5,16 |

Parent company

Income statement (KSEK)

| Q3 | Q3 | YTD | YTD | FY | |

| 2023/24 | 2022/23 | 2023/24 | 2022/23 | 2022/23 | |

| Net sales | 4 847 | 2 751 | 7 886 | 6 880 | 9 837 |

| Cost of products sold | -1 637 | -916 | -2 647 | -3 413 | -4 968 |

| Gross profit | 3 210 | 1 835 | 5 239 | 3 467 | 4 869 |

| Gross margin | 66% | 67% | 66% | 50% | 49% |

| Selling expenses | -1 668 | -843 | -4 498 | -4 568 | -6 076 |

| Administrative expenses | -1 590 | -2 671 | -3 379 | -6 510 | -8 170 |

| R&D expenses | -2 363 | -1 641 | -6 244 | -5 579 | -6 782 |

| Operating result (EBIT) | -2 411 | -3 320 | -8 882 | -13 190 | -16 159 |

| Financial net | -1 850 | -85 | -3 394 | -237 | -2 836 |

| Result before tax (EBT) | -4 261 | -3 405 | -12 276 | -13 427 | -18 995 |

| Net Result (EAT) | -4 261 | -3 405 | -12 276 | -13 427 | -18 995 |

Balance sheet (KSEK)

| Q3 | Q3 | FY | |

| 2023/24 | 2022/23 | 2022/23 | |

| ASSETS | |||

| Non-current assets | |||

| Intangible assets | 23 069 | 17 825 | 19 654 |

| Tangible assets | 613 | 652 | 608 |

| Financial assets | 12 066 | 8 795 | |

| Total non-current assets | 35 748 | 18 477 | 29 057 |

| Current Assets | |||

| Inventory | 3 962 | 3 272 | 3 332 |

| Short-term receivables | 5 565 | 11 633 | 4 080 |

| Cash and equivalents | 10 947 | 4 988 | |

| Total current assets | 9 527 | 25 852 | 12 400 |

| Total assets | 45 275 | 44 329 | 41 457 |

| EQUITY AND LIABILITIES | |||

| Equity | 20 265 | 16 086 | 10 518 |

| Financial liabilities | 18 191 | 22 380 | 20 580 |

| Operating liabilities | 6 819 | 5 863 | 10 359 |

| Total equity and liabilities | 45 275 | 44 329 | 41 457 |