Year-end Report 2018/19

February – April 2019

| Net sales | 1 361 (2 180) KSEK |

| Operating result | -4 953 ( -1 955) KSEK |

| Net result | -6 350 (-3 820) KSEK |

| Earnings per share | -0.46 (-0.33) SEK |

May 2018 – April 2019

| Net sales | 4 601 (4 449) KSEK |

| Operating result | -17 424 (-8 393) KSEK |

| Net result | -23 050 (-14 118) KSEK |

| Earnings per share | -1.75 (-1.21) SEK |

In short

- Net sales for the quarter decreased by 38 % to 1 361 (2 180) KSEK. For the full year net sales increased by 3 % to 4 601 (4 449) KSEK.

- The cash flow during the year amounted to -20 774 (-17 381) KSEK, excluding funding and amortization.

- The decline in earnings relative to the previous year is mainly due to that expenses accounted for as development costs and other deferred costs have decreased significantly.

- The gross margin amounted to 44 (67) % for the quarter and 62 (65) % for the full year.

- The rolling 12-month sales at the full year was 4.6 (4.4) MSEK.

- The contacts initiated during the second half of 2018 with two internationally leading industry players have developed in a very positive direction.

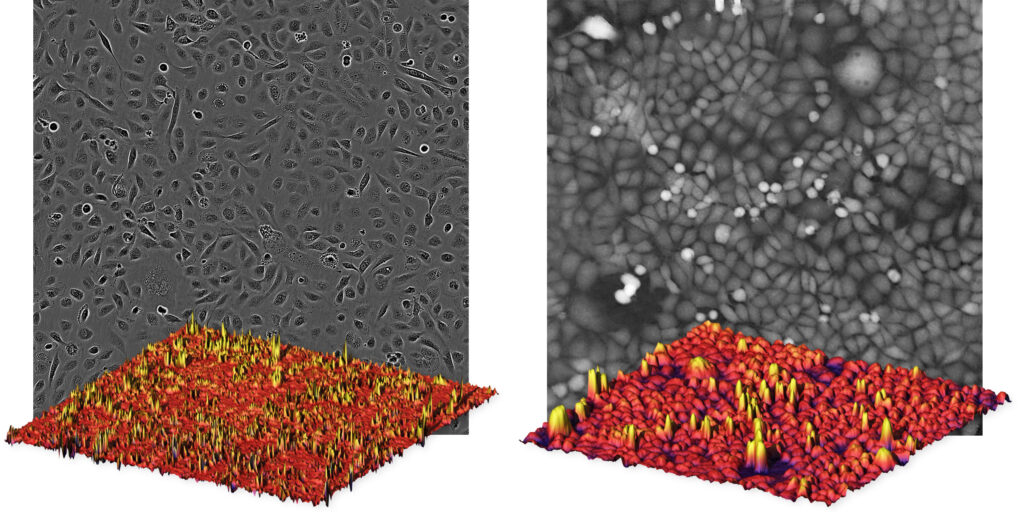

To the left, Conventional Microscopy, to the right, Holographic Microscopy.

CEO Commentary

The contacts initiated during the second half of 2018 with two internationally leading industry players have developed in a very positive direction. The goal is to establish our products in the American and international market with a large global marketing organization. Significant management and personnel resources have gradually been allocated to this activity, which in the short term has affected our own sales operations.

Recently, at a meeting with a company, both sides concluded that HoloMonitor extraordinarily well complements and refines the company’s existing product range of cell analysis instruments. It was also found that the question of a future partnership from a sales and marketing perspective is a “no-brainer”. The issue is more a question of finding business terms that benefit both parties.

industry players’ interest is based on the HoloMonitor® App Suite software launched during the year, enabling fully automated analysis of individual cells. To illustrate why App Suite enables this, the composite image above shows cell images taken with conventional (left) and holographic microscopy technology (right). Below each image, the image is also displayed as a 3-dimensional image, where the height is determined by the brightness of each pixel. In contrast to the conventional image on the left, it is easy to distinguish the individual cells in the 3-dimensional holographic image to the right, in which each cell creates a peak. This is the reason why the App Suite enables fully automated cell analysis, unrivaled in the industry.

The year’s loss may at first glance appear to be remarkably high in relation to previous year, especially when the actual cost increase stopped at 3.4 MSEK. The reason is that costs accounted for as development costs and other deferred costs have decreased significantly, which has a negative impact on this years result but increase the earnings in the coming year.

The after the year raised 18 MSEK means that we have the leeway to in the best way possible finalize the solid and ongoing discussions with leading industry players, together with any additional players that may join.

Link to the report.